How to Become A Member

How to join a credit union? Sign up online, or book an appointment at a branch to become a member today!

Join Online

If you’re wondering how to join a credit union online, our BCU Financial online personal banking marketplace allows you to join on your phone in a few easy steps!

Simply add a membership share and any personal banking products you want to open to the basket. Follow the process using our secure and convenient Marketplace. It takes just a few minutes!

- Fast, secure and convenient account opening

- Get account verification done on the spot

- Simple process done through your phone

- Scan the QR code to continue online account opening on your phone.

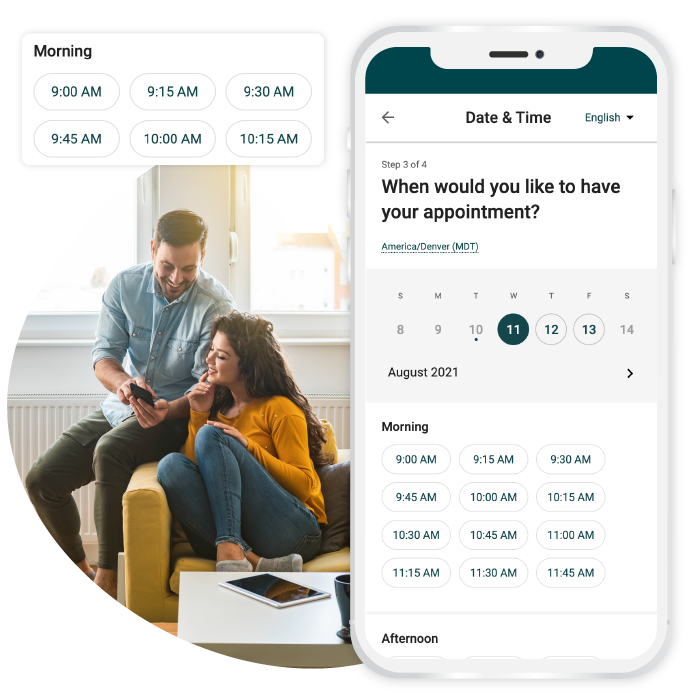

Book an Appointment

Schedule your branch appointment effortlessly and conveniently to access personalized financial guidance and begin your BCU Financial credit union membership.

» Valid Driver’s Licence

» Valid DND 404 Driver’s Licence (Department of National Defense)

» Valid Passport

» BC Provincial Services Cards (British Columbia only)

» Provincial or Territorial Photo ID Card

» Secure Certificate of Indian Status Card (issued by the Government of Canada)

» Permanent Resident Card

» Valid Major Credit Card (showing the MasterCard, VISA, or American Express symbol having your name and signature present on the card)

» Certificate of Canadian Citizenship or Certification or card – not a commemorative issue of Naturalization, in the form of a paper document

» Valid Citizenship and Immigration Canada documents; IMM 1000, IMM 1442, or IMM 5292 (with a valid copy of stamped Passport if the document was ceased by Immigration Canada)

» Valid Citizenship and Immigration Canada Work or/Study or/Minister’s Permit documents

» Birth Certificate

» Citizenship card (issued prior to 2012)

» Nexus Card

» Valid Firearms Licence

» Valid Outdoors Card – Hunting or Fishing (15 digits starting with 708158)

» CNIB Identification Card

Note: You cannot use a provincial health card for identification purposes where it is prohibited by provincial legislation. Under provincial legislation, provincial health cards from Ontario, Manitoba, Nova Scotia, and PEI are not permitted to be used for identification purposes.

Patronage Plan

Our primary focus is you – our member. BCU is committed to ensuring that you receive value for your membership and we focus on the issues that matter most to you.

But, we take one step further. As a member, you share in the Credit Union’s profits in more ways than one. A dividend is paid on your Bonus Shares, and with the introduction of patronage dividends, you earn an additional bonus for allowing us to handle your daily financial transactions.

Through the BCU Patronage Plan, you earn not only dividends on your existing shares, but can also earn patronage rewards based on your business with BCU, including your loans, mortgages, saving accounts, GICs, as well as other services. The more business you do with BCU, the more patronage rewards you earn. The amount that the BCU Patronage Plan distributes is decided every year by the BCU Board of Directors based on the profitability of the Credit Union.

Further to the 2014 BCU Annual General Meeting, members supported the Dividends for Ukraine initiative and directed BCU Patronage Plan dividends – calculated based on your business with BCU – to humanitarian aid projects, aid to soldiers and their families, and refugees in Ukraine affected by the Russian invasion of Eastern Ukraine and the aftermath of the ongoing war.

Since 1998, the BCU Patronage Plan has returned $11.8M back to our members and to member directed causes. Since 2014, more than $750,000 has been directed toward humanitarian aid projects and our brave soldiers as part of Dividends for Ukraine. BCU and it members are honoured and committed to support the brave women and men as they continue to demonstrate their resilience and dedication to their country.